WHO IZ CLEAN ENERGY

Click to set custom HTML

Loading

ANU STOCKS

ANU STOCKS TRADING MARKET

Market Data by TradingView

Economic Calendar by TradingView

Stock Market by TradingView

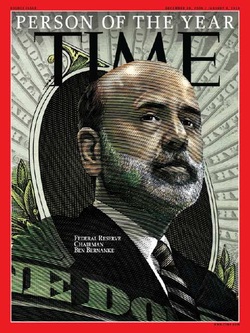

Battleground between Russia and West is China - Jim O’Neill (6:22)

April 11 - Jim O’Neill, former Goldman chief economist, says investors remain bullish on Russia. He argues the EU and US need to court China, rather than impose sanctions, if they want to hurt Putin’s economy.

A market asset manager can't help us right now because he iz allso living under no illusion of nuclear radiation in his food and water with no cure . so yes get your fiscal house in order eveyone.

|

Forex Rates by TradingView

Al Jazeera

Live commodities widget is provided by DailyForex.com - Forex Reviews and News

Cryptocurrency Markets by TradingView

http://de.pimco.com/DE/pages/default.aspx

EURO'S ,DOLLARS,AND YENS

NEW ECB BOSS CHRISTINE LAGARDE COULD ENACT BITCOIN FRIENDLY LEGISLATION

Provided by IFC Markets

HERE ARE TO GOOD SITE TO SAY WELL MAYBE WE SHOULD DONATE SOMETHING MY MIC IZ HOT TOO. http://www.tse.ir/en/ http://www.world-exchanges.org/WFE/home.Asp _

YEAH WE GOING TO ANOTHER MOODYS DOWN GRADE ARE YOU READY , HERE WE GO.

WELL LOOKS LIKE THAT JOB HIKE WAS HYPE NOW THE REAL DEAL.

NO MAIL , POOR GOV. PERRY I WOULD LOVE TO HELP WITH HOUSE AND SENATE

BUT YOU GOT THAT ALL UNDER CONTROL. YEAH THAT NO MAIL JOBS WILL BE HELL ON THE

PEOPLE BUT HEY MAYBE THEY WILL LISTEN WHEN IT REALLY IZ TO LATE IZ IT TO LATE YET ?

WELL THE ECON. IZ GETTING WORST AND IN THE STATE I AM IN FROM HELPING THIS COUNTRY

CHINA ,RUSSIA ,GOD WHERE IZ THERE A PLACE FOR PTAH OOOPS!!!

MORE DOWN GRADES FOR THE USA

AMERIKARMA IZ HERE CAN A CANIDATE FIX IT CAN OBAMA FIX IT OR CAN YOU?

I KNOW WHO, YOU KNOW WHO IT IZ .

NO MAIL , POOR GOV. PERRY I WOULD LOVE TO HELP WITH HOUSE AND SENATE

BUT YOU GOT THAT ALL UNDER CONTROL. YEAH THAT NO MAIL JOBS WILL BE HELL ON THE

PEOPLE BUT HEY MAYBE THEY WILL LISTEN WHEN IT REALLY IZ TO LATE IZ IT TO LATE YET ?

WELL THE ECON. IZ GETTING WORST AND IN THE STATE I AM IN FROM HELPING THIS COUNTRY

CHINA ,RUSSIA ,GOD WHERE IZ THERE A PLACE FOR PTAH OOOPS!!!

MORE DOWN GRADES FOR THE USA

AMERIKARMA IZ HERE CAN A CANIDATE FIX IT CAN OBAMA FIX IT OR CAN YOU?

I KNOW WHO, YOU KNOW WHO IT IZ .

Pivot Calculator

GONE AND GET THIS ANUSTOCK. EVEN THO THEY WILL NOT BE SENSIBLE

AND DO THE RIGHT THING AND LET THEM MERGE. IT WOULD HELP THE ECONOMY AND ALL OF US.

BREAKING CHINA

Overview

It has become clear China's old playbook of "invest and grow" no longer works so well. For all its successes, China suffers from the effects of overbuilding and unbridled credit growth. The country's new leadership may engineer a true shift toward a consumption economy – which will reverberate well beyond China.

About 50 leading BlackRock portfolio managers and external experts recently exchanged views on China's economic trajectory at the BlackRock Investment Institute's China Forum. Many went in bullish and came out still bullish – but with much less complacency and certainty. This site and the publication Braking China…Without Breaking the World discusses the main factors driving the economy, signposts for change and implications for investors.

View US PDF

View International PDF

We are optimistic on China's economic trajectory in the short term. A nagging worry is markets already factor in a "soft landing" this year, and only downside risk remains. We are concerned about China's ability to keep up its economic march in the long run. Challenges are big and solutions are not easy:

It has become clear China's old playbook of "invest and grow" no longer works so well. For all its successes, China suffers from the effects of overbuilding and unbridled credit growth. The country's new leadership may engineer a true shift toward a consumption economy – which will reverberate well beyond China.

About 50 leading BlackRock portfolio managers and external experts recently exchanged views on China's economic trajectory at the BlackRock Investment Institute's China Forum. Many went in bullish and came out still bullish – but with much less complacency and certainty. This site and the publication Braking China…Without Breaking the World discusses the main factors driving the economy, signposts for change and implications for investors.

View US PDF

View International PDF

We are optimistic on China's economic trajectory in the short term. A nagging worry is markets already factor in a "soft landing" this year, and only downside risk remains. We are concerned about China's ability to keep up its economic march in the long run. Challenges are big and solutions are not easy:

- An explosion in credit growth resulting from Beijing's 2009 stimulus has made the financial sector the economy's Achilles heel and its biggest long-term threat. The country can pave over problems this year, but the bills will come due.

- The real estate slump is the biggest threat to economic growth and confidence this year. Can Beijing break a vicious circle of falling prices and sales? (When it is ready to do so.)

- Powerful interests are stacked against a true shift to a consumption economy: exporters, state enterprises and local governments.

- Beijing is not almighty: Local governments tend to go their own way and a desire for consensus has often resulted in political paralysis.

- Real wage growth, rising materials costs and environmental restrictions are changing the workshop of the world – for the better.

!-- Start TC2000 widget -->

WHATZ NU IN THE EU!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

TAIWAN STOCKS

_http://www.treasury.gov/Pages/default.aspx

NU IZMHOUSE IN ORDER

ANU STOCKS TV

Technical Analysis - Free Forex Widget